A Leading Player in the Healthcare Sector

UNH stock belongs to one of the largest managed healthcare companies in the world. The company operates across multiple segments. These include health benefits, pharmacy services, and data analytics. Its size gives it a strong position in a competitive industry.

Over the years, UNH has built a broad network of healthcare providers. This network supports millions of members. The company’s reach extends into many states and international markets. That scale makes it hard for smaller rivals to compete.

Investors often view UNH stock as a defensive play. Healthcare remains in demand even during economic slowdowns. This stability appeals to those seeking long-term growth with less volatility than other sectors.

Performance Trends and Market Sentiment

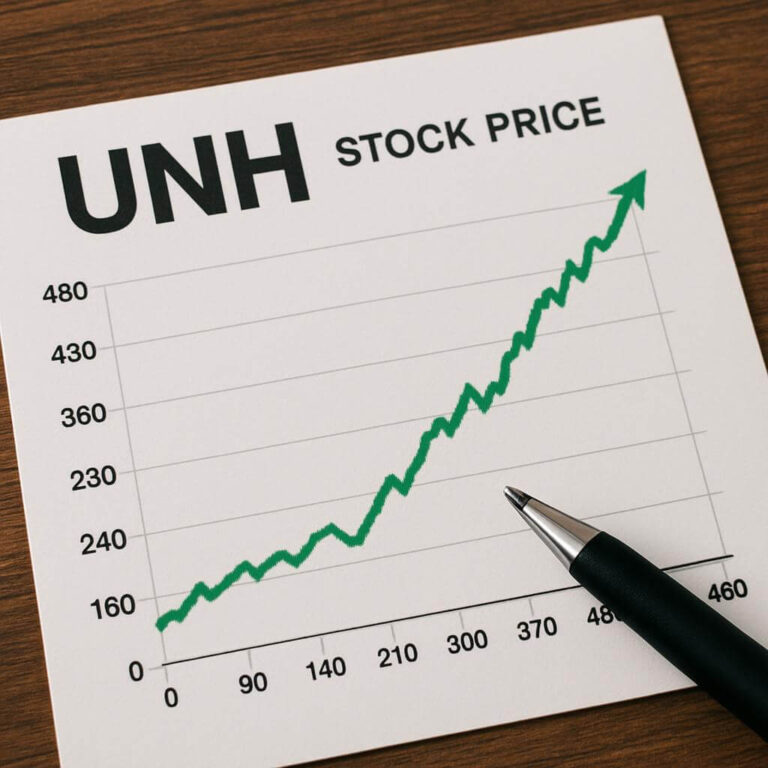

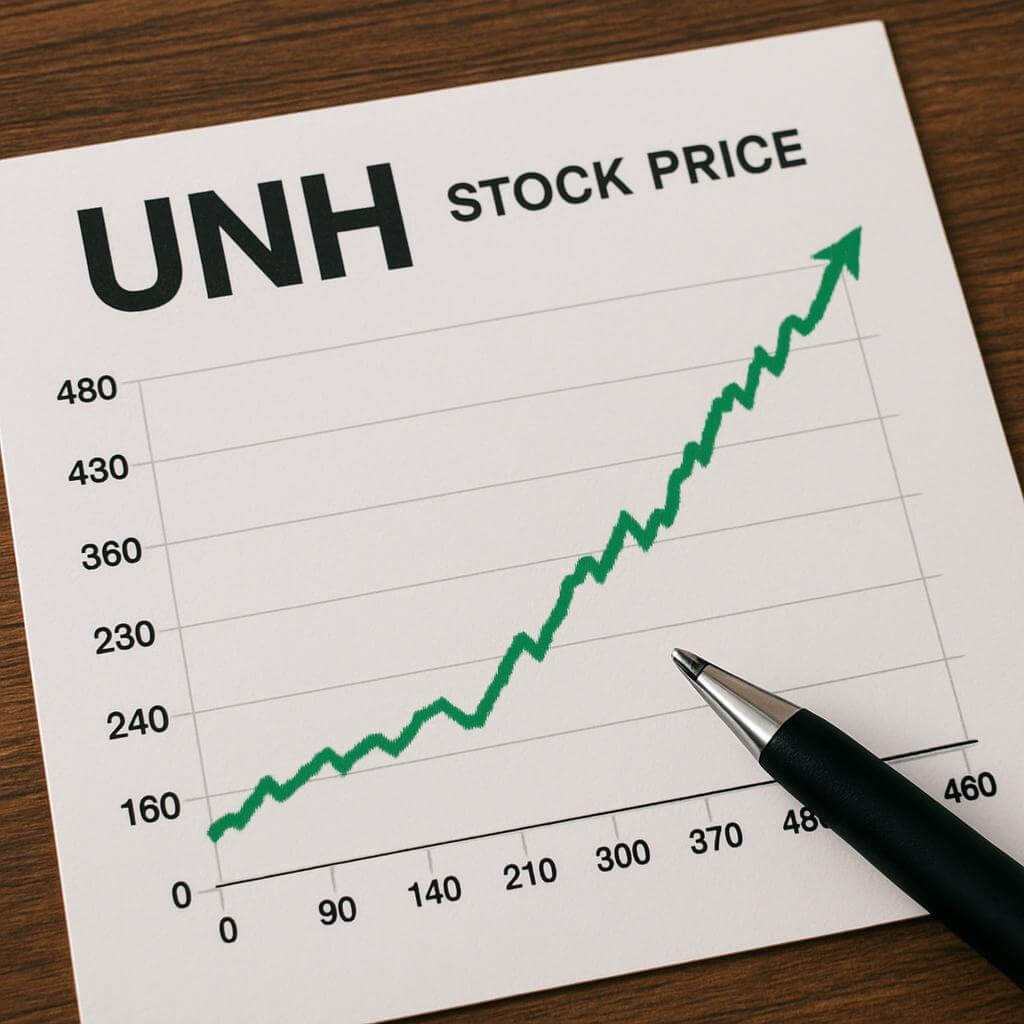

In recent months, UNH stock has shown resilience despite market shifts. The share price has moved steadily upward after brief pullbacks. Quarterly earnings reports often exceed expectations. Revenue growth comes from a mix of membership gains and expanded services.

The company also invests heavily in technology. Digital health tools, telemedicine, and analytics improve service efficiency. These innovations enhance patient experience and help control costs. In turn, this strengthens the brand’s reputation and keeps members engaged.

Analysts frequently highlight UNH stock’s strong fundamentals. The combination of consistent revenue, solid margins, and a reliable dividend makes it a favorite among institutional investors. While short-term market trends can create dips, the long-term outlook stays positive.

Dividends and Shareholder Value

One of the attractive features of UNH stock is its dividend policy. The company has a track record of increasing payouts over time. This shows management’s confidence in future earnings. For long-term investors, a growing dividend provides a steady income stream.

Share buybacks also play a role in enhancing shareholder value. By reducing the number of shares in circulation, the company increases earnings per share. This can help support stock price growth over time.

Financial discipline has been a key factor in UNH’s success. The balance sheet remains strong, with manageable debt levels. This gives the company flexibility to invest in growth opportunities without overextending itself.

Outlook for UNH Stock in the Coming Year

Looking ahead, UNH stock appears set to maintain its upward trajectory. Aging populations and rising demand for healthcare services create long-term tailwinds. The company’s diverse revenue streams reduce risk from any single segment.

Potential challenges remain. Regulatory changes, competitive pressures, and economic slowdowns can influence performance. However, UNH’s size and adaptability give it tools to respond effectively. Strategic acquisitions and partnerships may further strengthen its market position.

For investors, UNH stock offers a blend of stability, growth, and income. It appeals to those who want exposure to healthcare without taking on excessive risk. While no stock is without uncertainty, the company’s history and strategy suggest a steady path forward.

In short, UNH stock represents more than just a share in a healthcare company. It reflects the growing importance of health services in daily life and the economy. With strong fundamentals, a clear growth strategy, and a focus on delivering value to shareholders, it remains a notable option for those building a long-term portfolio.